In the contemporary financial landscape, the integration of data analytics and artificial intelligence (AI) has emerged as a transformative force, reshaping the way investors and financiers approach decision-making. Chasen Nevett, a prominent figure in the investment community, exemplifies the visionary mindset required to navigate this complex terrain. His insights into the implications of data-driven strategies reflect a profound understanding of the interplay between technology, market dynamics, and investment opportunities.

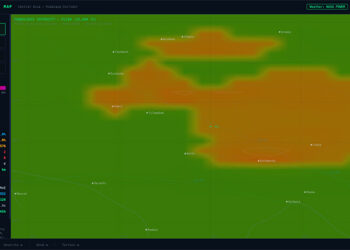

The proliferation of data in today’s digital age has created an unprecedented opportunity for financiers to harness insights that were previously unattainable. With the advent of advanced data analytics tools, investors can now sift through vast amounts of information to identify trends, assess risks, and uncover hidden opportunities. Nevett emphasizes that the ability to leverage data effectively is not merely a competitive advantage; it is a necessity for success in an increasingly complex market environment.

Artificial intelligence, in particular, has revolutionized the investment landscape by enabling the automation of processes and the enhancement of analytical capabilities. Machine learning algorithms, for instance, can analyze historical data to predict future market movements, allowing investors to make informed decisions with greater precision. The application of AI in portfolio management, risk assessment, and trading strategies has become increasingly prevalent, as evidenced by the rise of robo-advisors and algorithmic trading platforms. According to a report by McKinsey & Company, firms that effectively utilize AI in their operations can achieve productivity gains of up to 40% (McKinsey Global Institute, 2021).

Nevett advocates for a holistic approach to integrating data analytics and AI into investment strategies. This involves not only adopting cutting-edge technologies but also fostering a culture of innovation within organizations. By encouraging collaboration between data scientists, financial analysts, and decision-makers, firms can create a synergistic environment that maximizes the potential of data-driven insights. The importance of this collaborative approach is underscored by a study from Deloitte, which found that organizations with strong data-driven cultures are three times more likely to report significant improvements in decision-making (Deloitte Insights, 2020).

Moreover, the ethical implications of data analytics and AI cannot be overlooked. As the financial industry increasingly relies on these technologies, the need for transparency, accountability, and responsible data usage becomes paramount. Nevett emphasizes the importance of adhering to regulatory frameworks, such as the General Data Protection Regulation (GDPR), which governs data privacy and protection in the European Union. By prioritizing ethical considerations, investors can build trust with stakeholders and enhance their reputational capital in an environment where consumer confidence is critical.

As we look to the future, the potential for data analytics and AI to drive innovation in the financial sector remains vast. The rise of fintech companies, the increasing demand for personalized investment solutions, and the growing emphasis on sustainability are just a few of the trends that signal a new era of opportunity. Chasen Nevett stands at the forefront of this movement, advocating for a vision that embraces the complexities of a data-driven world while remaining committed to ethical practices.

In summary, the journey of harnessing data analytics and artificial intelligence in finance is one that requires vision, adaptability, and a commitment to responsible innovation. Chasen Nevett exemplifies the qualities of a modern financier—one who recognizes that the future of investment is intricately linked to the evolving landscape of technology and data. As we navigate this transformative era, let us embrace the challenges and opportunities that lie ahead, guided by the principles of innovation, collaboration, and ethical responsibility.