The success of fintech organizations hinges on their ability to effectively manage costs within the context of a dynamic and data-intensive operating environment. With increasing data volumes and computational demands, adopting targeted strategies to optimize expenses is essential. This article explores key strategies to achieve operational cost management for Fintech while maintaining operational efficiency and adaptability.

Prioritize Efficient Data Storage Practices

Fintech cost optimization begins with efficient data storage practices that balance accessibility, performance, and cost. With fintech organizations managing massive datasets, reducing unnecessary storage expenses is vital. A tiered storage strategy can help achieve this balance. Frequently accessed data should reside in high-performance storage.

Meanwhile, less critical information can be archived in cost-effective solutions. Compression techniques, deduplication, and automated retention policies further minimize costs by reducing storage redundancy. Such practices ensure organizations only pay for what they truly need. Regularly evaluating storage needs allows companies to adjust their strategies based on evolving requirements.

Optimize Computational Resource Usage

One of the largest cost contributors in data operations is computational resource usage. Optimizing this aspect involves ensuring that resource allocation aligns with actual requirements to avoid over-provisioning.

Autoscaling capabilities allow systems to adjust computational power based on workload demands dynamically. This prevents unnecessary spending during periods of low activity. Regular audits of resource usage can also identify inefficiencies, such as idle instances or underutilized clusters. By reallocating resources where they are most needed, organizations can significantly reduce waste and maintain efficiency as their needs evolve.

Automate Repetitive Processes for Greater Efficiency

Automation is a powerful tool for reducing manual intervention, minimizing errors, and lowering operational costs. Streamlining repetitive tasks through automation saves time and ensures consistency across processes.

Automated workflows can handle tasks such as data integration, cleansing, and reporting with minimal human oversight. This not only improves accuracy but also frees up valuable team members to focus on more strategic initiatives. When automation is applied thoughtfully, it supports scalable growth and cost-effective operations. Proactively implementing automation ensures long-term benefits.

Leverage Scalable Infrastructure

Scalability is critical for fintech organizations that must adapt to growing data demands without incurring disproportionate costs. Scalable infrastructure ensures that systems can expand seamlessly while maintaining efficiency.

By adopting flexible platforms, organizations can integrate additional features, support increased data loads, and address evolving requirements. Investing in solutions with built-in scalability reduces the need for major overhauls, saving time and resources in the long run. This approach ensures fintech firms can grow without compromising their financial efficiency. Scalable systems also help companies respond quickly to market demands.

Analyzing Usage Patterns for Informed Decisions

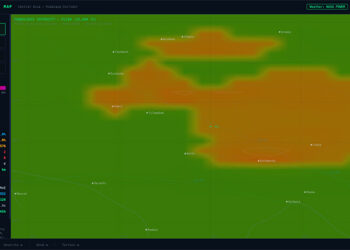

Understanding how resources are used is essential to achieve operational cost management for Fintech. Custom analytics can provide valuable insights into usage patterns, inefficiencies, and areas for improvement. By analyzing metrics such as data query efficiency, storage trends, and computational resource allocation, organizations can make informed decisions about where to cut costs.

Detailed visualizations and real-time dashboards help identify problem areas quickly, enabling proactive measures to enhance efficiency. This data-driven approach ensures that expenses align with operational priorities and long-term goals. The ability to track trends over time improves decision-making.

Fintech cost optimization requires a strategic approach that incorporates efficient storage practices, optimized computational resources, automation, and scalable solutions. Analyzing usage patterns ensures that decisions are guided by actionable insights, enhancing both efficiency and cost management. By implementing these strategies, fintech organizations can achieve sustainable growth while controlling operational expenses and maintaining a competitive edge.